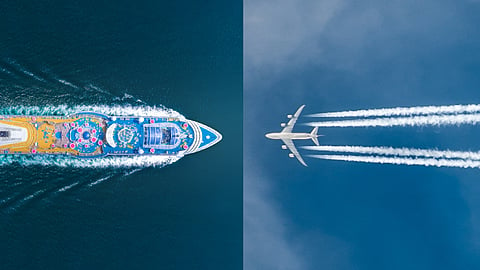

Aviation and Shipping: Two Transportation Sectors, So Close Yet So Far

In October, 2021, online valuation and data provider VesselsValue launched a daily valuation platform for the aviation industry. Ten months down the line, the company has come up with an analysis of the two sectors - Vessels versus Aircraft.

Here VesselsValue has highlighted the similarities and differences between the two asset types, in an article by Senior Aviation Analyst Darrel Biddlecombe.

"In this article, firstly, we compare the value changes since January 2020 for one of the largest common types of Bulker (Capesize) and one of the largest common Commercial Passenger aircraft (777-300 ER), as well as the typical workhorses of a Handy Containership and A320-200 aircraft," VV stated.

Later, VV has commented on the similarities and differences in the geographical operational restrictions, maintenance checks and location tracking for both vessels and aircraft.

Valuing the assets, what has happened since January 2020

The last time VV released an article on the similarities and differences, it had picked up several comparable assets and showed their values and value changes. Now, the company analyses what has happened during Covid-19 and the current state of affairs.

King Abdullah Port Reports Growth in Container Shipping for H1 2022

Using Fixed Age Vessels and Aircraft at 5 years old, the following figures show the comparison between January to June of the last three years between vessel and aircraft counterparts.

Between 1st January 2020 and 1st June 2022, Capesize Bulker values for 5 year old vessels increased by 53.7% over the last two and a half years, whilst values for 5 year old Boeing 777’s decreased by 6.5%.

January to June value changes in 2020, 2021 and 2022

Meanwhile, as shown below, Handy Container values for 5 year old vessels increased by 152.8%, whilst values for 5 year old Airbus A320’s decreased by 2.4% over the same time period.

January to June value changes in 2020, 2021 and 2022

Comment on some similarities and differences

Geographical Operational Restrictions

One of the obvious differences is their environments of operations. One bound by the ocean, the other by the sky. However, there are many other considerations and comparisons that make these assets more alike than expected.

Shipping restrictions of operation include the depth, canal, shipping lane widths, and territories. Aviation, however, is only bound by FIRs, or flight operation regions, and authorities that control the sky.

These might be the obvious ones, but as with ship size restricting operations, so is the case with size of aircraft. For example, certain aircraft are unable to fly some routes because of their size range, and how far in an emergency they can land.

Another interesting point is berthing or landing. Some ports and airports have restrictions on allowance.

In the same way that an aircraft cannot land if the runway is not long enough, a ship cannot go into a port if it will be grounded for doing so. Bathymetry of the ocean controls where ships can and cannot go.

Occasionally, even when allowed and unrestricted, both can suffer issues. Where the tide is a major factor in Shipping, wind speeds at 40,000 ft can be major factors in an aircraft’s ability to be punctual for arrivals and departures.

That said, wind is also a major factor in Shipping, as seen in 2021 with the Ever Given obstructing the Suez Canal, blocking the route for over 350 ships and causing losses in trade of nearly $10 billion.

Maintenance Checks

A ship will have regular surveys to ensure it is safe to continue operations, whereas an aircraft will have a whole host of checks, although some of the checks on aircraft are just short and observational.

While aircraft enter checks and borescope inspections, vessels in turn will have dry dock inspections. These heavy checks and dry dock inspections are considerably expensive and can render an aircraft or vessel as no longer viable from a financial perspective.

AIS or ADS-B

Ultimately, these two acronyms are synonymous in their methods of operation and in their essential goals. These are both systems used to track the location of vessels and aircraft, as shown in Figures 5 and 6.

AIS is Automatic Identification System

ADS-B is Automatic Dependent Surveillance Broadcast

Both systems use terrestrial transponders alongside satellite data to position and track assets and their cargo, whether it be passengers in aircraft, freight in vessels, or even tracking the movements of private aircraft and Superyachts.

Concluding thoughts and considerations

Whether in finance, insurance, asset management or banking, there are many synergies in what businesses want to know about assets, their features, past whereabouts, and where they are now.

More importantly, the economic climate has recently shown how delicate these markets can be and how they change at pace in reaction to world events. Businesses need to know whether their money is protected and well looked after, which is where our data holds value.

Read More: IATA Lauds States' Progress Towards Net-Zero Aviation Emissions